Employee Expense Management for MIP Fund Accounting

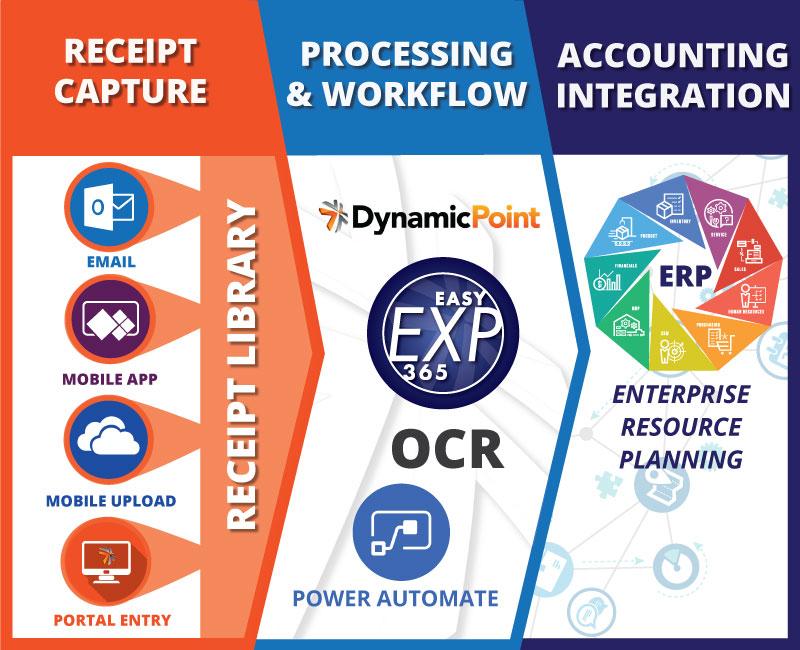

Are you a MIP Fund Accounting user and still managing employee expenses using spreadsheets and email? Did you think an enterprise grade Employee Travel and Expense solution that integrates with MIP Fund Accounting was out of your reach? What if there was an option to leverage what you already own to automate employee expense reimbursement, namely Office 365? That is exactly what DynamicPoint has accomplished. We have brought together MIP Fund Accounting, Office 365, and lastly, our EasyEXP365 travel and expense processing application to cost effectively capture receipts, route for approval, and create the appropriate accounts payable, general ledger or payroll transaction in MIP Fund Accounting.

Why Do I need Expense Management with MIP Fund Accounting?

EasyEXP365 automates the otherwise manual collection, approval and processing of employee expense reports with MIP Fund Accounting. Employee out of pocket and corporate credit card expenses are coded directly to MIP GL accounts. Depending on the type of expense recorded, payables are created in MIP for employee payment or journal entries are written to account for corporate credit card transactions.

MIP Fund Accounting Expense Management with EasyEXP365

How does DynamicPoint’s EasyEXP365 work with MIP Fund Accounting?

DynamicPoint’s approach is to continue to fully support MIP Fund Accounting as the accounting system of record. We query employees directly from the application, validate GL accounts, verify expenses are coded correctly and ultimately create the accounts payable, GL, or payroll transaction directly in MIP Fund Accounting. There are no syncs or data being moved from one system to the other. We instead use live integration to deliver seamless MIP Fund Accounting compatibility.

Want to learn more?

Check out our recent demo videos, view pricing details or schedule a 1:1 product demonstration.