While there are many advantages of using Microsoft Office 365 for AP Invoice Automation, including Power Automate for workflow and SharePoint for document management, one of the biggest advantages is that all of the data stays within your environment. A convenient benefit of owning your data is that you can report on it however you choose. And there is not a better tool for achieving this analysis than Power BI.

Benefits of Power BI Reporting

Power BI, a powerful business report development and analytics tool from Microsoft, enhances the capabilities of invoice automation software by providing robust reporting and analytical features. Here are some reasons why Power BI is a preferred approach:

Data Visualization:

Power BI allows businesses to create insightful dashboards and reports that visualize AP invoice data in real-time. This capability enables the accounts payable department to identify financial trends, monitor key performance indicators (KPIs), and make data-informed decisions.

Customizable Reporting:

Unlike other AP Automation vendors that provide static reports, Power BI offers flexible report configuration options. Report developers and power users can create custom reports tailored to specific business needs, such as vendor analysis, payment trends, and budget forecasting. This flexibility ensures that your accounts payable department gets the analytical details they need, specific to your requirements.

Integration with Multiple Data Sources:

In addition to pulling in data from SharePoint, which is where the DynamicPoint app stores your AP invoice data, Power BI includes numerous additional data sources, including ERP systems, on-prem databases, and cloud services. This integration flexibility allows the invoice automation solution to consolidate data from otherwise disparate sources into a single dashboard, providing a holistic view of your AP approval workflow, aging, and payment details.

Real-time Analytics:

With Power BI, businesses can access invoice details on a real-time basis. This capability is important for monitoring operational efficiency, identifying bottlenecks in the invoice approval process, and implementing timely improvements.

Scalability and Accessibility:

As companies grow, their data analytics needs evolve. Power BI scales with the organization, accommodating larger datasets and more complex reporting requirements. Its cloud-based architecture enables stakeholders to access reports anytime, anywhere, using any device.

Comparing with Other Options

While there are alternative AP Automation and reporting tools available, Power BI stands out for its integration with Microsoft products (like Excel and SharePoint), flexibility and its user-friendly interface. Additionally, licenses are fairly inexpensive, especially for companies who are already Microsoft 365 subscribers.

Conclusion

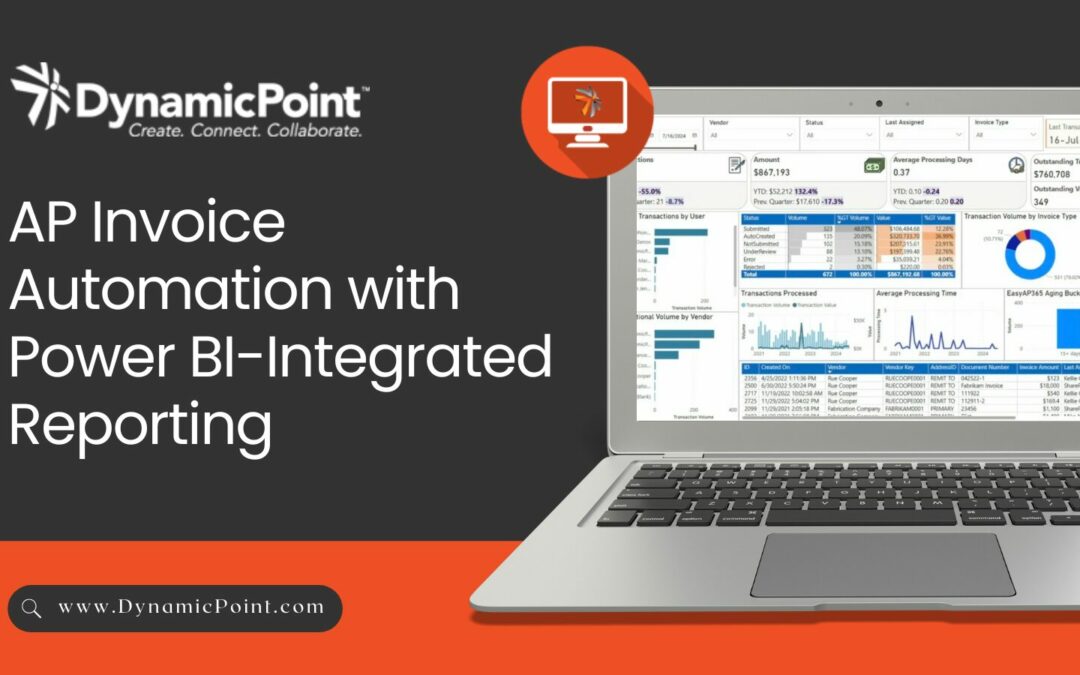

Incorporating Power BI into invoice automation applications enhances efficiency, improves decision-making capabilities, and drives operational savings. By leveraging advanced reporting and analytical features, companies can streamline invoice management processes and reduce costs. That is why DynamicPoint has selected to use this as its primary reporting tool. Of course, you don’t have to start from scratch, as we provide many report templates and dashboards to get you started. Such as the one below.