The situation in Canada is a little different. The Canadian equivalent of sales tax, Goods and Service Tax (GST), is designed to be cost-neutral for most businesses. Although it must be paid at the point an expense is incurred, it can later be claimed as a credit when filing taxes. Further complicating the issue is that certain provinces also impose their own version of a GST, namely Provincial Sales Tax (PST). Other provinces have opted to combine the two into a single Harmonized Sales Tax (HST).

Although there are specific rules on the calculation and application of this credit, it puts an imperative on the employer to collect the amount of an expense that is related to GST, PST and HST when an employee completes an expense report. Aside from the data collection during the creation of an expense report, the tax amounts must also be recorded to the specific GL accounts. Unlike the US, only the net amount is recognized as an expense while the amount associated to tax is placed in an asset account that is later reconciled during tax filing. In our example of a meal that was incurred for 100 dollars, where 10 dollars was related to tax, the resulting GL entries look like this:

– Payable to Employee 100 (Cr)

– Meal and Entertainment Expense 90 (Dr)

– Tax Asset Account 10 (Dr)

Of course in addition to recording the entries to the appropriate GL accounts, the employee must be reimbursed for the amount paid out of pocket. In most ERP apps, this is best accomplished through the creation of an invoice in the payables module where the employee is represented by a vendor record. When the employee is paid the employee payable account is offset by the cash account. Click here to see our list of integrations with various ERP applications.

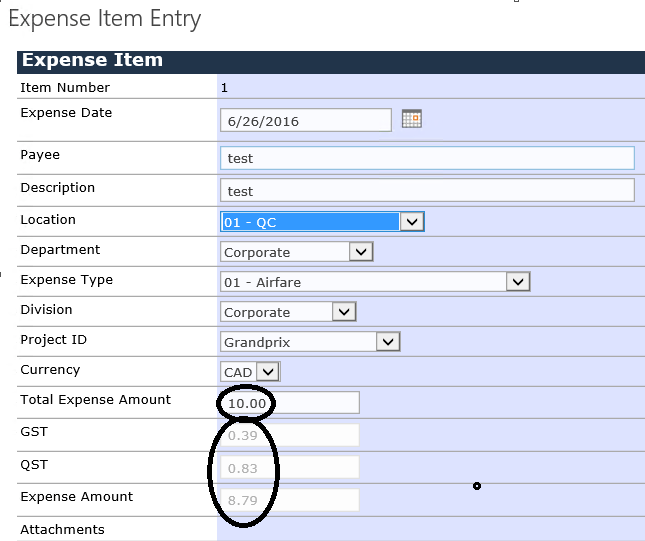

The specification of these taxes in DynamicPoint’s expense management application, EasyEXP365, looks like this:

Prior to the creation of the invoice in the ERP or accounting system, there is typically the review and approval of the expense report by managers, accounting, etc. This will include validating the expenses are justified as well as substantiating the expense with any receipts or supporting documentation.

Watch this short 3 minute video to see how simple the user interface is for your employees to create an expense report notating the various Canadian taxes along with the integration to Dynamics.

Mike Marcin, DynamicPoint – Business Apps for Office 365