Corporate credit card management is a built in feature of the EasyEXP365 product. The solution entails the following:

- Credit card transactions are daily fed into Office 365 using a live feed with your banking institution

- Transactions are assigned to employees based on the card issued to them

- Employees can assign transactions to the appropriate job or expense type (GL account)

- Coded transactions are routed for workflow (using Power Automate), or directly integrated with your ERP system, as a journal entry from a mobile Power App or desktop experience

- Transactions are easily reconciled with the monthly statement when it is received

The process looks something like this:

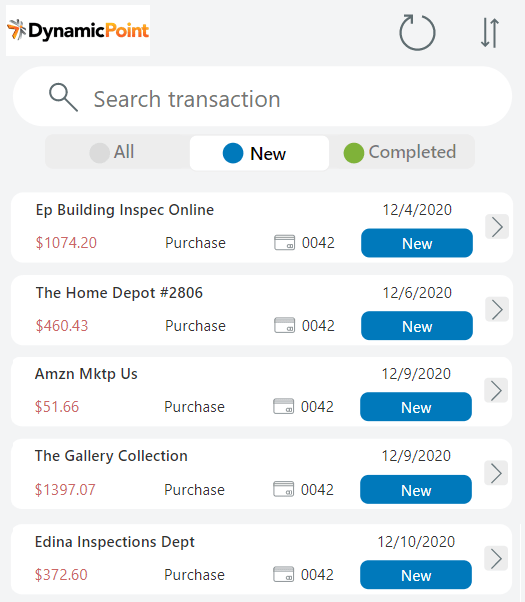

Here is a screenshot of the employee’s Power App in which they can easily review their transactions, upload supporting receipts, and submit for approval or integration into your accounting system:

Here is a short video that shows exactly what that process looks like:

DynamicPoint’s Office 365 Expense Management Solution helps your organization by providing the visibility your AP department needs to keep credit card expenses streamlined and accurate.

Interested in Learning More About EasyEXP365?

EasyEXP365 product page OR Sign up for a Live One-on-One Demo